The rush is on to 3rd Party Delivery but how “economic” is it? Most restaurant brands and analysts have described delivery sales as “highly incremental”, but so far, I have not seen anything written about the cost side and/or the resulting margins. I was fortunate to moderate a terrific panel on this topic at the Restaurant Finance & Development Conference, featuring a comprehensive panel from Red Robin, CoreLife Eatery, McAlister’s Deli and Pincho Factory.

Delivery has been growing at a double digit rate and is forecasted to accelerate further, according to reports from Cowan and Company, and Jeffries. So, many concepts have jumped in, but according to our RFDC audience, most operators are either unhappy or uncertain with their current delivery situation.

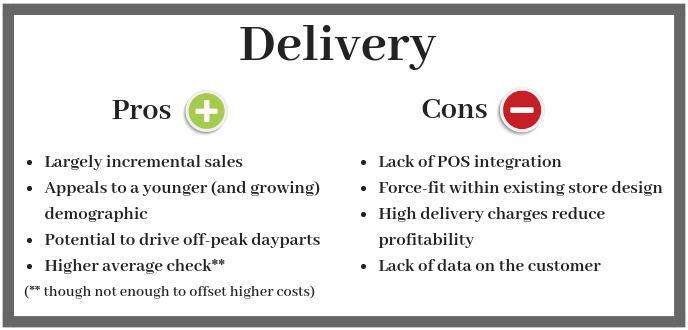

The panel agreed that, overall, 3rd party delivery is “a mixed bag”, and cited several Pro’s and Con’s:

McAlister’s Deli and Pincho Factory shared actual results on overall Delivery margins :

➡️ McAlister’s uses a full labor allocation resulting in Delivery’s dollar margin only being about 50% of their Takeout margin. However, they are currently in test with slightly different pricing that would enable them to get to 90% of their average To-Go margin.

➡️ Pincho Factory has seen only a marginal increase in labor cost with delivery. They therefore assign only “incremental labor” to delivery; the result is their margins are much better than if they were loaded with full labor. With the highest delivery percentage of sales at >15%, Pincho is paying very close attention to the economics.

How can you improve profitability? ? The panel offered several strategies for operators:

1. It is essential to manage labor very closely. One brand adds no labor. Another brings in one additional team member to work peak hours only. ![]()

2. Be smart about the delivery menu offered. Sell items that a) travel well and b) that offer a favorable food cost. Menu layout and what you feature can have a major impact. You can even include catering items.

3. Two of the four panelists are actively involved in testing price elasticity with delivery.

4. If you have multiple delivery providers, try to “push” incoming orders to the more profitable provider.

Finally, there were two other noteworthy takeaways from the panel:

– Red Robin brought up the recent actions taken by Chipotle and Zoe’s. These two brands are using their third-party provider only for the delivery, with orders being placed through the brands’ websites. I believe this method would give these brands the key customer data everyone feels is a must-have.

– Relatively new brand, CoreLife Eatery (~50 units), views delivery as 4th in importance to their model : 1) Dine In, 2) Rapid Pickup, 3) Catering, and 4) Small Order Delivery.

So, one additional way to make more money is to keep delivery in perspective, and focus on more profitable pieces of the business. I felt this was an excellent strategic insight…not only for new brands, but for any brand.

If you have additional thoughts and/or strategies for enhancing the profitability of delivery…I’d love to hear about them — please send my way.

Best, Neil

For 15 years, Growth Partners has provided outsourced Chief Marketing Officer consulting to restaurant companies. I am a fresh set of eyes for current CEO’s/ CMOs, as well as an Interim or Part-Time CMO for concepts looking to grow their businesses and brands. Follow me on Facebook @growthpartnersllc or at www.growthhq.com.