I went to the new Food on Demand™ conference last week, to immerse myself in the widely-talked-about Delivery space and “off-premise” dining. More than 300 attendees came to this first-time conference including ChickFilA, Culver’s, Denny’s…to see what they could learn. Here were my takeaways:

I went to the new Food on Demand™ conference last week, to immerse myself in the widely-talked-about Delivery space and “off-premise” dining. More than 300 attendees came to this first-time conference including ChickFilA, Culver’s, Denny’s…to see what they could learn. Here were my takeaways:

▶ Is Delivery Here to Stay or a Passing Fad?

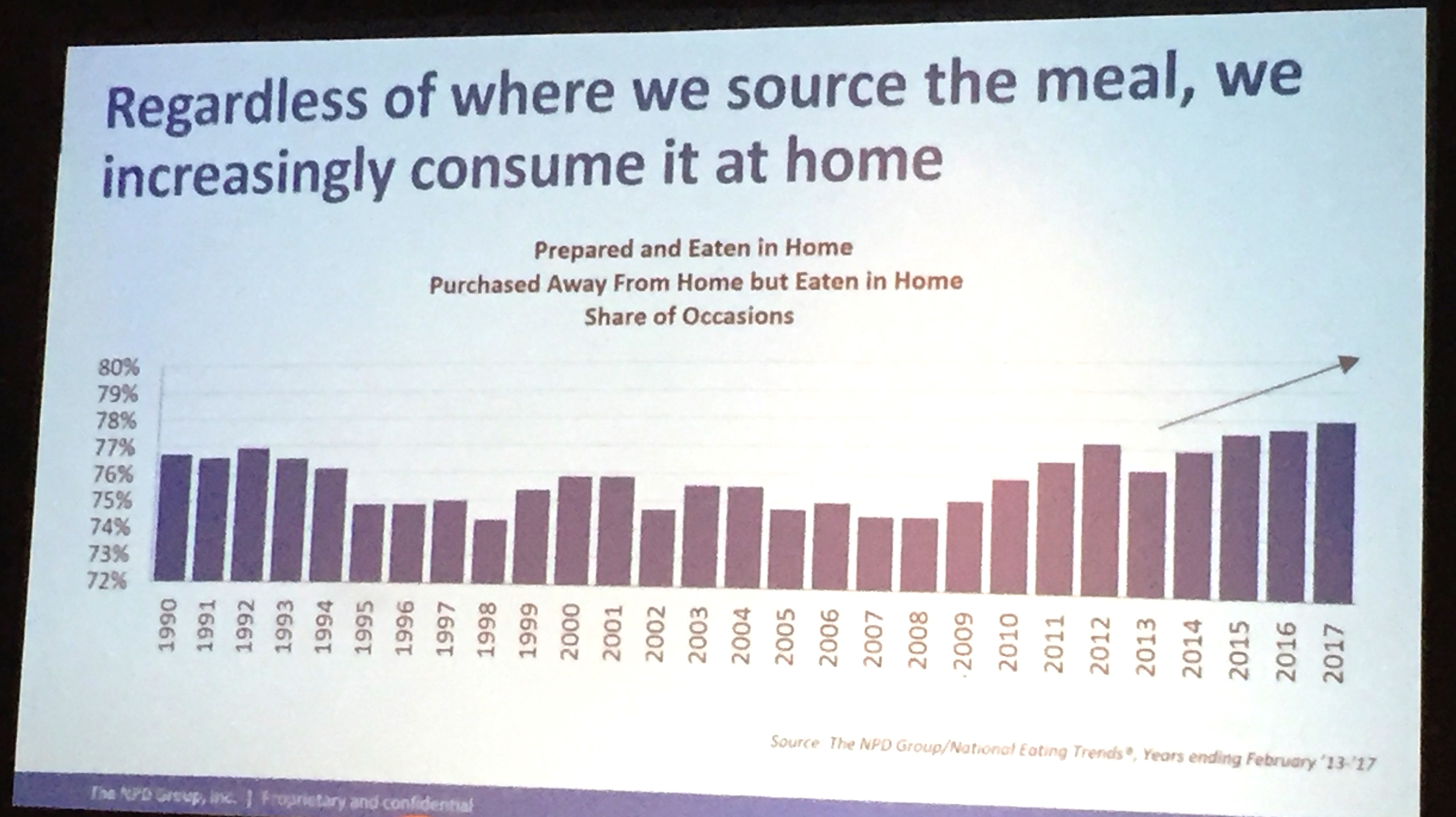

The trend of consumers choosing to eat at home more often is real.

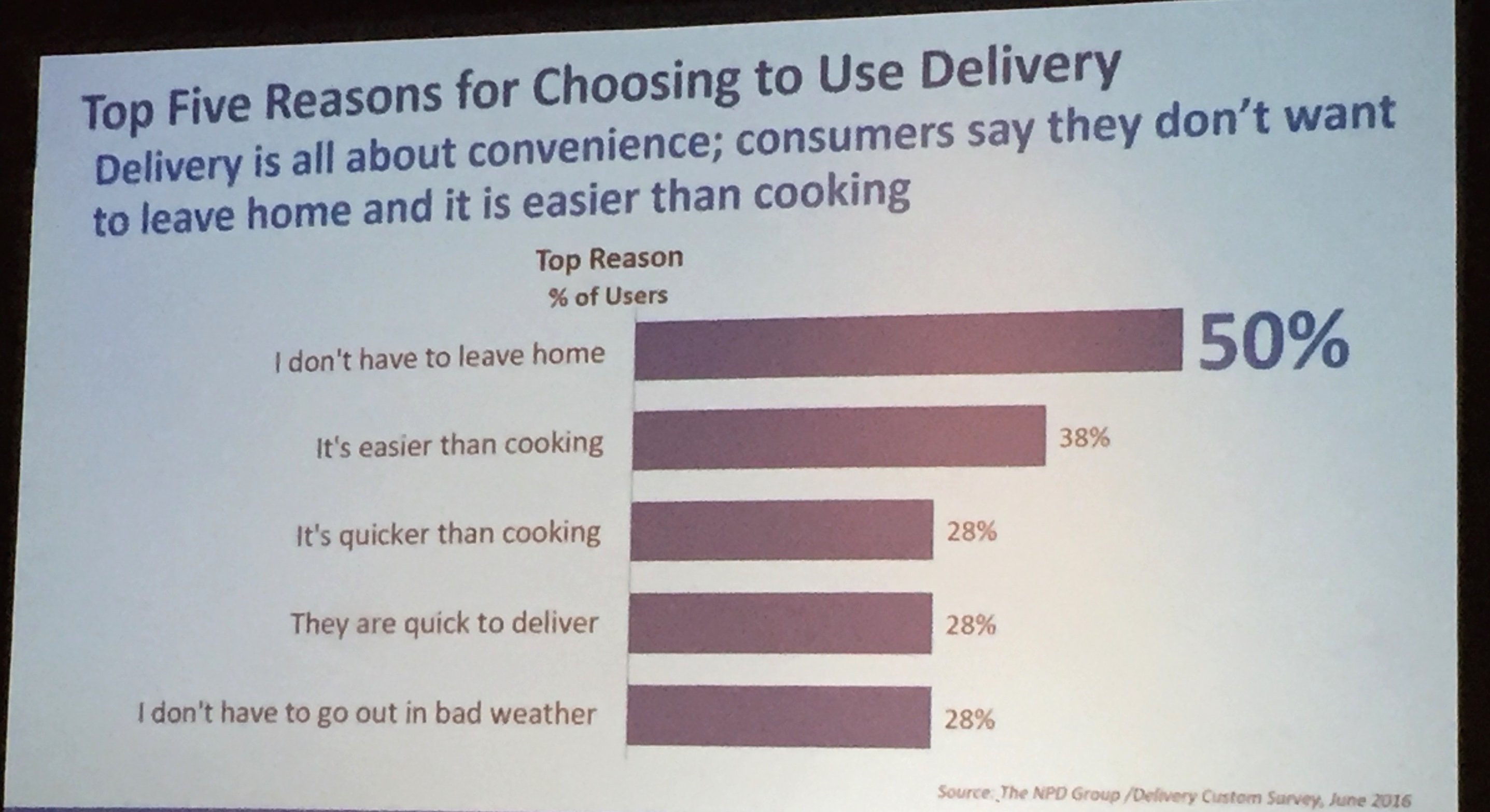

Delivery is consumers’ new convenience option for good reason – regardless of food type! The number one reason? “I don’t have to leave home.”

When NPD reported that Delivery – Excluding Pizza had increased +40% over the past five years, and that Millennials and Gen Z represent 60% of total Delivery traffic, I think everyone agreed that we are witnessing a permanent consumer shift.

▶ Can you make $$ in Delivery?

This is the most difficult question today. I liked the way Boston Consulting Group’s Allan Hickok termed it, namely that delivery is “….solvable but at a significant cost today.” Unfortunately, margins are lower on a percentage basis (due to 3rd party fees); however, checks are higher – in some cases significantly. Case in point, CEO Laura Rae Dickey of Dickey’s BBQ said their average delivery check is $23-25 versus a dine-in check of $15 – a 53-66% increase! ? While everyone seemed to be looking for a solution to lower the costs of third-party delivery, I did not hear anyone from DoorDash, GrubHub, or Uber mention any near-term plans to reduce their fees. (OLO’s new Dispatch product is an alternative that I would recommend evaluating.) So, given that this is a fundamental consumer shift, it is a conundrum for brands: pursue at lower flow-through margins or give up market share?

▶ So, does your brand need to deliver?

Since same store sales are one of the key metrics in our industry, public companies are under significant pressure to deliver. According to some estimates, Delivery could TRIPLE in size. But, today, NPD’s research indicates that delivery represents only 3% of transactions; this means 1) you haven’t missed the boat, and 2) it’s a competitive fight for a small share of business. Dickey’s said it was “not a choice” for them – that they would lose -8% of their business to competition without delivery. Wowzer! On the other hand, CEO Gene Lee at Darden said recently that they are not convinced today in the profitability of small-scale delivery. So there is no one right answer. However, the core demographic – Millennials and Gen Z – will continue to age up and experience a decrease in discretionary time as careers, marriage and children come into the picture; Delivery demands will undoubtedly grow alongside them.

So, the answer to my central question is: No, Delivery cannot be ignored. Every smart brand needs to be evaluating their specific situation and asking: what do my current and desired guests want? Today, Delivery should be in your priorities, but not necessarily at the top. Start researching and testing so that you can see how your own brand performs because while small today, how big will Delivery be in 3 years?

If you could use some help with your strategy and plan for Delivery, I would love to talk through it, along with the additional learnings gained at Food on Demand.

Best,

Neil

For fifteen years, Growth Partners, LLC has provided outsourced Chief Marketing Officer consulting to restaurant companies. I am a fresh set of eyes for current CMOs, as well as an Interim or Part-Time CMO for concepts looking to grow their businesses and brands. Learn more at www.growthhq.com.